Want to get in on that sweet tax refund action while visiting Korea?

This post shows you how!

It covers:

- How much Korean tax refund is

- How they work

- Where to get a refund

- How to get an immediate refund

- And more!

Tax refunds overseas are complicated, and Korea is no exception (I had to read instructions in Korean and English to understand).

Let’s check it out!

Korean tax refunds are part of a government program that allows foreign tourists to get a refund on VAT (value added tax) when purchasing goods or services worth over 30,000 KRW (22 USD) but under 5 million KRW (4,700 USD).

You can get a tax refund at Incheon Airport, downtown, or immediately at participating stores. Medical services including cosmetic surgery or skin treatments, and some hotels are also covered by this program.

For a quick explanation on how to get a tax refund, check out the article below.

*** Disclaimer ***

The information here is valid as of January 2024. Tax refund rules change regularly. Make sure to check the Korean Customs Service website before traveling to South Korea.

Korea has a great tax refund system that I have used on a few occasions. The biggest refund I received was for a Samsung Laptop for 200,000 KRW (155 USD).

How do tax refunds work in Korea?

Korea’s Tax Free System can be divided into two categories, tax refund and duty-free.

Tax refund means you can get the Value Added Tax (VAT) and Individual Consumption Tax on certain items refunded at the airport before leaving Korea.

Duty-free means the taxes are excluded when you shop at a duty-free store. Easier but limited in selection.

More about Online Shopping in Korea

The end result may be the same, but their procedures are quite different.

How do I get a tax refund?

This process is a bit more complicated than just shopping duty free. There are a few hoops to jump through, so make sure to arrive at the airport at least 30 minutes earlier than usual.

The benefit is that you have a much wider range of products to choose from all over Korea. Don’t worry, we’re here to simplify things.

Step 1

Ask for a tax refund receipt/document at the register when you buy a product that meets the previous criteria at a designated shop. You’ll have to show your actual passport and provide flight info, so make sure to have that handy while shopping.

For example, if you shop at Yeouido The Hyundai, bring your receipt to a tax refund service desk on the 6th floor and ask for a tax refund receipt.

Step 2

When you arrive at Incheon Airport, don’t check in refund items or any luggage that will hold refund items and tell the person at the check-in counter that you intend to get a tax refund for them.

Step 3

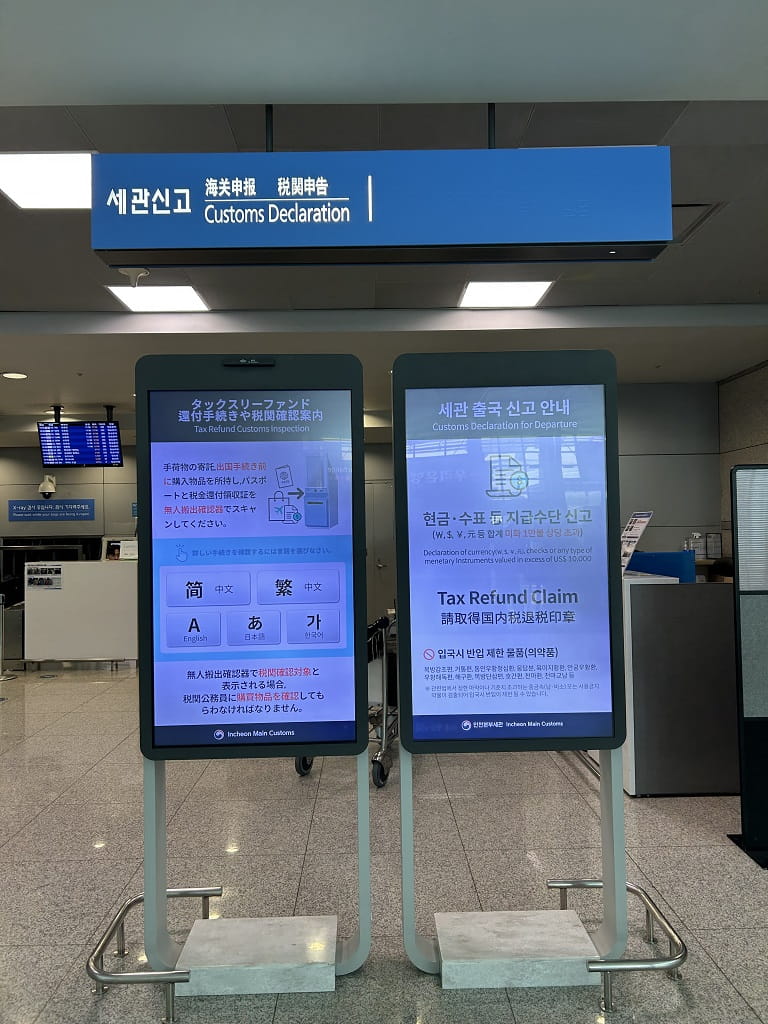

Bring the item, receipt and VAT refund receipt to the Customs Declaration Counter to get a Customs Export Approval stamp on the document.

There’s a kiosk, but the service isn’t always available.

If an item costs over 75,000 won, you can’t use a kiosk as the staff needs to verify the actual item. Rules seem to keep changing. So… If you’re lucky and able to use the kiosk, you can automatically get a tax refund to your credit card. This kiosk is before Immigration.

Step 4

Take your luggage to the oversized baggage counter to check it in.

Step 5

Finally, take the stamped tax refund slip to the Tax Refund Counter and get your refund. You’ll probably be able to only get cash in USD, JPY or KRW, although the tax refund receipt says that card refund is available. Go figure.

Insider Tips

* Tax Refund Counters

- Terminal 1: Next to Gate 28 on the 3F

- Terminal 2: Next to check-in counters D and E on the 3F / Near Gate 253 in duty-free zone

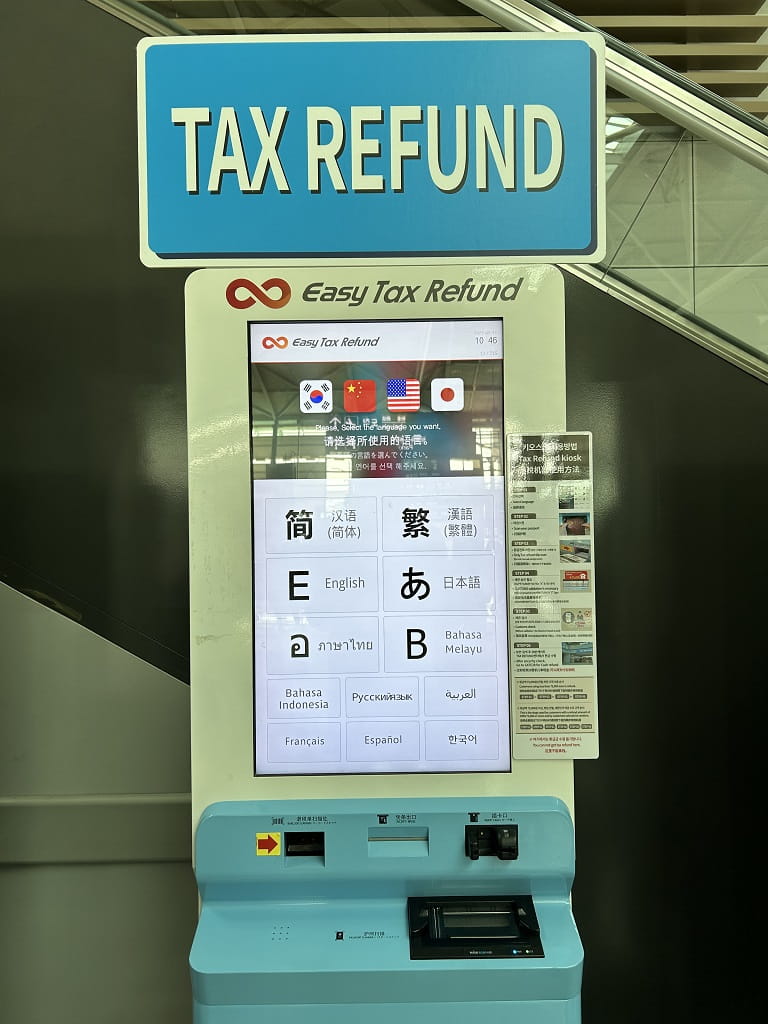

* Tax Refund Kiosk Machines

– Duty Free zone: 4F Gates 26 & 27 in Passenger Terminal 1 / 3F Gate 253 in Passenger Terminal 2

* Tax Refund Kiosk Machines

- Terminal 1: Next to Gate 28 on the 3F / Near the central pharmacy on the 3F

- Terminal 2: Next to Gate 250 and 253 on the 3F in duty-free zone

***Update***

As of January 1, 2024, you’re able to receive an immediate refund in stores for items that cost more than 30,000 KRW and less than 700,000 KRW. Make sure to have your actual passport and flight info on hand as well.

These immediate refunds are limited to a total purchase amount of less than 2,500,000 KRW during your trip.

If this method works, I highly recommend it over getting a refund at the airport. It will save you a ton of hassle.

***

How much is VAT in Korea?

Korean VAT (value added tax) is 10% on most goods and services. The merchant must collect the tax and pay it to the government. Fortunately, it’s built into the price, so you don’t need to calculate it and get awkward amounts of change.

Some small shops or street vendors might give you a 10% discount (deducting VAT) if you pay cash, but that’s between me and you 😉.

How much is the tax refund in Korea?

10% on items from participating stores. This varies depending on terms and conditions and the amount you spend.

Am I eligible for a tax refund in Korea?

You’re eligible to get a tax refund on goods worth over 30,000 KRW but under 5 million KRW in total. The items must be bought within three months of your departure.

Non-Korean tourists without an f-4 visa must have stayed in Korea for less than 6 months to qualify.

Overseas Koreans must have stayed for less than 3 months and lived overseas for over 2 years.

Is it worth getting a tax refund in Korea?

Depending on the amount you spent and your level of patience, getting a tax refund can be so worth it.

For example, I bought a 2,000,000 KRW (1,550 USD) laptop and received around 200,000 KRW (155 USD) back. I felt this was worth the effort.

There’s even a way to get refunded immediately in stores now. We’ll go over this in the next section.

Learning Korean

Guided conversation is the fastest way to get fluent in Korean. Pimsleur takes you from 0 to conversational in 90 days. You can try Pimsleur here for free!

Subscribe for

exclusive info on Korea

Conclusion

Getting a tax refund can be a bit complicated, but it’s usually worth it.

Let us know if you have any questions in the comments!

Disclosure: There are affiliate links in this article that provide us a small commission at no extra cost to you. We only endorse the best language learning tools we use ourselves. Find out more about our code of ethics.

Can you get tax refunds in SK if you’re a foreigner with an f-4 visa that’s stayed in SK for less than 6 months?

Hi Cara,

According to Incheon Regional Customs, foreigners, including F-4 visa holders, who stayed in Korea for 6 months or less should be eligible for tax refunds.

Hello,

I have a question here. I spent around $1000 CAN on medical expense and got tax refund receipt. I scanned my receipt at one of the downtown kiosk and was told the refund will be sent to the credit card I provided. I verified this at the international airport and was told it would take two days for refund to be received. It has been more than one week after I left Seoul and I still do not see the refund on my credit card. Is there anything I can do at this point. Thank you .

Hello Lynne,

It seems pretty hard to find that info online.

Perhaps, you can contact the tax refund office at Incheon International Airport (+82-32-743-0647)?

Best of luck!

Hi! Is the 5M won cap for the entire stay in Korea? Or for every claiming of tax refund? Thanks!

Hi Jen,

Yes, that’s for the entire stay of 3 months or less. Happy travels!

I went to South Korea on 15th September 2022 and came back on 3 October 2022. I wasn’t aware I could claim a tax refund until I came back so is it too late to claim it now and how do I do it.

Hi Annetta,

Unfortunately, you had to claim it in Korea within 3 months of purchase, so it wouldn’t work now. I hope you enjoyed your trip.

Am I correct that if I spent 11M KRW on an approved medical procedure and even have a Medical Tax Refund receipt with a refund of about 1M KRW, can I expect to get a refund or will it be considered over the 5M amount and ineligible?

Hi Anne,

I checked the and other relevant laws.

I couldn’t find a specific limit to medical service tax refunds.

It seems you should be eligible for the amount written on the “Certificate” issued by the Special Medical Institution that performed your surgery.

Your medical provider should inform you how much you can get, so be sure to check with them.

Hello, what if product is open and used? When they check the product but its in loose packaging isit alright?

Hello Tee,

Technically products need to be unused, but I’ve heard that you might be able to get a tax refund as long as you show the product.

Some removed packaging to save space and they still got refunded.

As long as you leave the country with the product, it should be okay.

Best of luck!

Hi thanks for the info! Does it matter where you purchase the products from? For example I am planning to purchase a laptop online (on Coupang as its cheaper) but do online purchases give tax refund certificates or receipts? Or is it only in store? I haven’t found any info on this yet.

Thanks

Hi May, you’re welcome! ^^

It actually matters where you shop because you need a VAT refund receipt for a tax refund.

Tax free stores with logos like Global Blue, Global Tax Free, Easy Tax Refund, Cube Refund, etc. should be able to handle it.

So, I’m not sure about Coupang. You can ask the seller, but it’s unlikely.

Have a nice day!

Shopping online I’m guessing won’t work as you would need to physically present your passport.

Yes, that’s right. You’d most likely have to go in person.

Hello.

I came to Korea in early December and I didn’t realise I could apply for a tax refund! I’m now back in Korea (so it has been less than the required 3 month period since purchasing the goods)

If I obtain a tax refund receipt from the store I purchased from now- will I be able eligible to get a refund for what I bought in December, even though I left and came back? Thanks!

Hi Pheobe,

That’s an interesting situation.

I’m not so sure, but I feel like as long as you leave Korea within 3 months from the date of purchase, you should be able to get a tax refund.

Just make sure to have both product and receipt ready.

Best of luck! ^^

Yes, it’s possible. I forgot to do tax refund for an item bought in March. Left Korea and came back in April, and got my tax refund for that item. I just did it at the downtown kiosk and didn’t even need to show my item at airport customs because it’s below ₩750k.

Hello. I am confused about 5M won uplimit tax refund. Is it the total amount we can get as a tax refund in one trip ? or we can only get a tax refund for total 5M won purchased goods? which means , Maximum tax refund we can get , is 500.000 won ? or not .

Because I done 6M won and 2M won different kinda purchase and did not understand , how much refund will I get. Thank you

Hello Mire,

Yes, it’s a bit confusing. The maximum amount of purchased goods eligible for tax refund is 5,000,000 won.

You can check this Customs website for more details.

I just returned from Korea, I used tax refund machine stationed in store, but didn’t verify at Airport. I did key in my CC number. Am I eligible for refund?

Hi Irene, I’m not sure about the tax refund machine in store.

If you mean instant tax refund, the store would’ve deducted the tax amount upon purchasing something.

If you used a kiosk machine at the airport, you may or may not need to go to the customs (you don’t need to if tax refund amount is less than 75,000 won).

Then, you need to go to another kiosk (Customs declare), then security screening & immigration, and finally getting refunds near gate 253 or opposite side of gate 249.

I hope you get your tax refund!

Hi; I bought a phone in korea but I couldn’t able to get tax free in airport before leaving. Is there any way to get tax free via online applying for tax free by declaring invoice and passport information? Thanks

Hi Mehmet,

I tried to find this info.

Unfortunately, I don’t think you can get a tax refund once you left the country.

hi

do we have to check in the item or can we put it in our carry on?

also do we have to show all of the items we purchased?

is it fine to remove the packaging and only show the bag with no tag?

thanks!

Hi Jc,

1. You can check in the items, but check in your luggage at the oversized baggage counter after showing them to the Customs Declaration Counter.

You can put items that are allowed on flights in a carry-on bag.

2. Yes, you need to show all of the items.

3. I’ve heard that you can remove the packaging.

Hope this helps!

Hi!

Thanks for this blog post, this is really complicated to understand what to do.

I have a question if I already got the tax refund at the store, do I still need to go through all the hastle at the airport and show the things in the customs?

All the best

Helena

Hi Helena,

No problem! You can skip all that if you already received your tax refund. It’s really nice!

I bought 1millon won of skin care. How can I claim a tax refund if the sizes of the bottles are greater than what I can bring on a plane?

Hi Laura,

You can check in to get your boarding pass, but tell them you’d like to check in your luggage after receiving a tax refund.

Then, go to the Customs Declaration Counter to get a Customs Export Approval stamp. After, you can check in your luggage at the oversized baggage counter.

Best of luck!

Amazing and useful article, thanks y’all! one question, considering you bought a laptop — did you have to show it to customs upon leaving and did it have to be in the closed packaging? I want buy an iphone and get a tax refund but I want to use it for my trip here as well, but I’m not sure if I should just leave it packed until I leave? Thanks y’all!

Hi Kayla, Thanks for reading!

I showed my laptop without the box.

I’m pretty sure you can use your iPhone during your trip, and get a tax refund.

If you want to play it safe, keep the iPhone box with you just in case.

Best of luck!

HI!

Just double checking. So, if I got an immediate tax refund at the store (paid in cash), I don’t have to do anything? Or should I scan my passport at the kiosk to double check?

Thanks,

Ayla

Hi Ayla,

Thanks for asking!

Yes, if you already got an immediate tax refund (meaning they deducted VAT from the price at the store), you don’t need to do anything else!

Hi & thx for the article. I find the refund process such a nuisance when I’m already strapped for time, however I was floored that you got a full 10% refund on your laptop! I’m a frequent traveler who loves to shop when abroad but never have I received the full VAT refund. Usually I get an insanely small amount back as more than half goes to the company that processes the refund, and I’ve had situations (certain companies) where you submit everything and drop an envelope full of receipts & personal info into a mailbox-type receptacle and the refund is to be applied to your credit card but I never receive the refund at all, and trying to chase it down requires A LOT of time and effort, and further expense.

On this current trip to Korea, I noticed the Chinese-owned cosmetics shops in Myeongdong offer the in-store refund but it amounts to something crazy like 1%! They make you feel like they’re saving you so much hassle but then you look at the receipt and realize there was barely a refund! What’s that all about?

Hi Jane,

I’m not so sure about cosmetic shops in Myeongdong, because I don’t shop there usually.

It might be better to try Olive Young (any branch) and ask for a tax refund.

What if I didn’t do this at the airport? Is there a way to do it online?

Hi,

Unfortunately, there’s no way to get a tax refund online.

As far as I know, you need to get it either at the airport or an eligible store in Korea.

Best of luck!

Hi,

Great article about tax refund in Korea.

Just want to ask if I got a downtown cash refund using the global tax free kiosk, and agree to put down a deposit on my credit card. But I don’t get to customs (no customs confirmation), if my credit card will be charged?

Hi Ben,

Thank you!

I think your credit card might be charged.

According to the Global Tax Free website, you need to get the customs validation within 25 days of the refund date.

Then, they will automatically cancel the deposit on your credit card, when tax free forms are cleared by customs.

Hi, do you have any idea on the minimum age required for foreigners who are keen to receive tax refund in Korea?

As far as I know, there isn’t one. As long as you don’t buy alcohol or tobacco. Hope this helps!